Below the surface of the record profits petrochemical companies have been reporting over the past few years, the industry is in a period of profound transition. Until the fall in oil prices, success in the industry had been based on stark regional asymmetries. Companies in fast-growing emerging markets such as China have thrived. So have companies in regions—in particular the Middle East and North America—with advantaged gas feedstock that they have made into petrochemicals and plastics and then exported to China and other growth markets. To put it bluntly, for the geography-blessed petrochemical players, it has been hard to go wrong.

Looking ahead to 2030, slower demand growth in emerging economies and less abundant advantaged feedstocks are likely to undermine these value-creation strategies. Companies will likely have to take a more disciplined approach to capacity additions, returns may be more modest, and all petrochemical players will need to work much harder on core capabilities and strategy. This will include using digital and advanced analytics to reach a new level of productivity, and attaining higher capital productivity on the industry’s large-scale projects. Companies must also work on reinventing the interface with oil refining as the gas-driven era winds down. At the same time, they will need to manage the transition from an essentially linear economy, where plastics-based products get used once before disposal, to a circular economy.

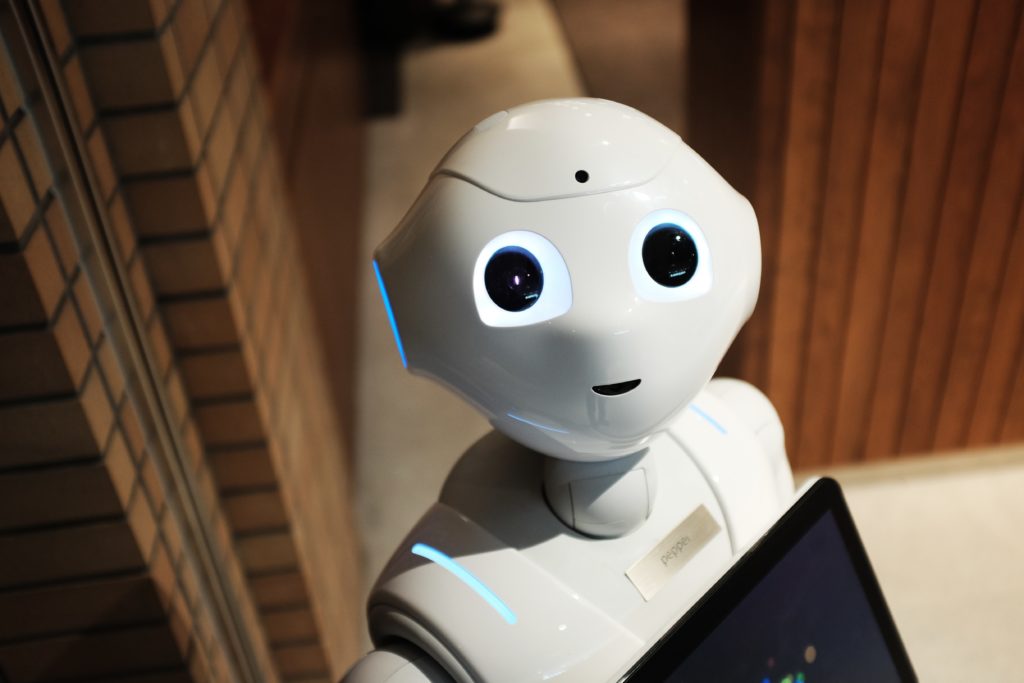

We are making investments in innovation!